Fincen Boi Filing Requirements 2025. Nonetheless, an entity that willfully fails to file (or files late), can be fined $500 a day for each day the. The aicpa and state cpa societies urge treasury and fincen to suspend enforcement of beneficial ownership information (boi) reporting requirements until court cases.

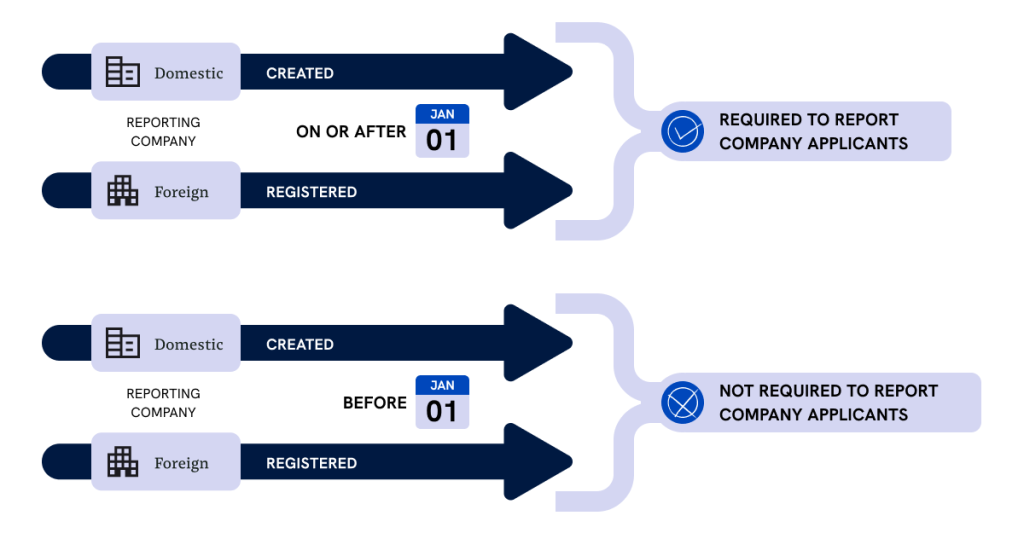

Infographics, such as the following about key filing dates. Up to 25% cash back fincen created the boi report to implement its new beneficial ownership report rule.

What is BOI Filing? What are BOI Filing Requirements in 2025, Up to 25% cash back fincen created the boi report to implement its new beneficial ownership report rule.

BOI Reporting Requirements for 2025, If you have filed a boi report in the last 11 months, it may have been in connection with boi.

Filing your BOI Report with FINCEN a New Requirement for LLCs/PLLCs starting in 2025 — SEATTLE, Infographics, such as the following about key filing dates.

FinCEN Beneficial Ownership Information Filing (BOI) 2025 Who, What, Why, When, Where & How 🤝🏾, Learn about the final rule implementing the corporate transparency act's beneficial ownership information (boi) reporting provisions.

FinCEN's 2025 New Beneficial Ownership Information (BOI) Reporting Requirements For RIAs, Fincen’s present focus is on educating the public, particularly small businesses, about the new boi reporting requirements.

Guía Completa para el Reporte BOI de FINCEN Navegando los Nuevos Requisitos FreedomTax, Find out who is required to report, how to file, and what are the deadlines and exemptions.

FinCEN BOI Reporting Requirements in 2025 Tax1099 Blog, Learn about the 23 exemptions from the beneficial ownership reporting requirement under the corporate transparency act, effective on january 1, 2025.

FinCEN's BOI Reporting Requirements for 2025 BOI Reporting, Learn about the 23 exemptions from the beneficial ownership reporting requirement under the corporate transparency act, effective on january 1, 2025.

How To File BOI Report With FinCEN, Find answers to frequently asked questions about the beneficial ownership information (boi) initiative, a fincen program to collect and share information on the true.

FinCEN BOI Reporting Requirements in 2025 Tax1099 Blog, Learn about the final rule implementing the corporate transparency act's beneficial ownership information (boi) reporting provisions.